Contributed by Bryan Jones, CEO, Truckbase.com

In the trucking industry, efficiency is paramount. With the ever-increasing demands of the modern supply chain, truckload carriers need trucking software tools that can streamline their operations and reduce manual tasks.

One of the most significant challenges faced by many trucking businesses is the disconnect between their operational tools and their accounting software. Enter QuickBooks — a leading accounting software used by millions worldwide.

As a carrier, you have a major gap: QuickBooks is excellent at producing financial reports, and your transportation management system (TMS) is excellent for trucking-specific workflows and reporting. The key is merging the two.

Here are seven considerations that will help you bridge the gap between your TMS trucking software and QuickBooks.

What is accounting software for trucking fleets?

Accounting software for truckers helps owner operators and carriers manage their trucking finances. It helps trucking companies track income, monitor expenses, and handle tax obligations specific to the freight industry.

Features often include invoicing, mileage tracking, and expense categorization. One of the most popular options includes QuickBooks customized for trucking. Using this trucker accounting software can streamline financial tasks and improve record-keeping.

Some trucking transportation management platforms offer basic truck accounting features like invoicing and expense tracking. TMS solutions, however, primarily focus on logistics and supply chain functions. For comprehensive accounting needs, TMS integration with specialized trucking accounting software is often required.

7 factors to consider regarding trucking software integration with QuickBooks

For growing asset-based carriers, especially in the 5-50 truck range, there are several key points to consider when choosing which trucking software best integrates with QuickBooks.

1. Avoid double data entry with seamless trucking software integrations

One of the significant pain points for many trucking businesses is the need to enter data in multiple systems. An integrated solution eliminates this need, ensuring that data entered in the TMS is automatically synced with QuickBooks.

When a trucking company is manually copying data from their TMS into QuickBooks, this consumes valuable time and increases the risk of errors. Trucking software like Truckbase allows for seamless integration, ensuring that data entered in one system is automatically reflected in the other.

How much time is your team wasting by entering data in one system and then copying it to the other? Truckbase has found that the average team using their software has reduced manual data entry by over 30%. That should be a target when you integrate your use of QuickBooks for trucking and your core trucking software.

2. Operational metrics and KPIs

While QuickBooks is a robust accounting tool, it may not provide all the KPIs and operational metrics specific to the trucking industry. Integrating it with a specialized TMS can give you insights that help in decision-making and improving your business operations.

For example, QuickBooks produces reliable and flexible reporting that can be sliced on daily, weekly, monthly, and annual bases. But how does that translate to truck-level KPIs? Which drivers seem to be most profitable? Which lanes and which customers? Are there certain brokers with whom you’re spending an inordinate amount of time serving with check calls? Are there certain trucks that seem to have disproportionate maintenance issues?

Using QuickBooks for trucking most effectively means joining these two data sets so that they can work in harmony. That’s when the magic is unlocked: with QuickBooks and your TMS working together.

3. Advanced rate type flexibility and customization

Not every carrier TMS offers the flexibility that QuickBooks does. Inversely, QuickBooks doesn’t meet all the flexibility that a carrier TMS provides. It’s essential to choose a TMS that can integrate with QuickBooks without compromising on flexibility to meet your unique business needs.

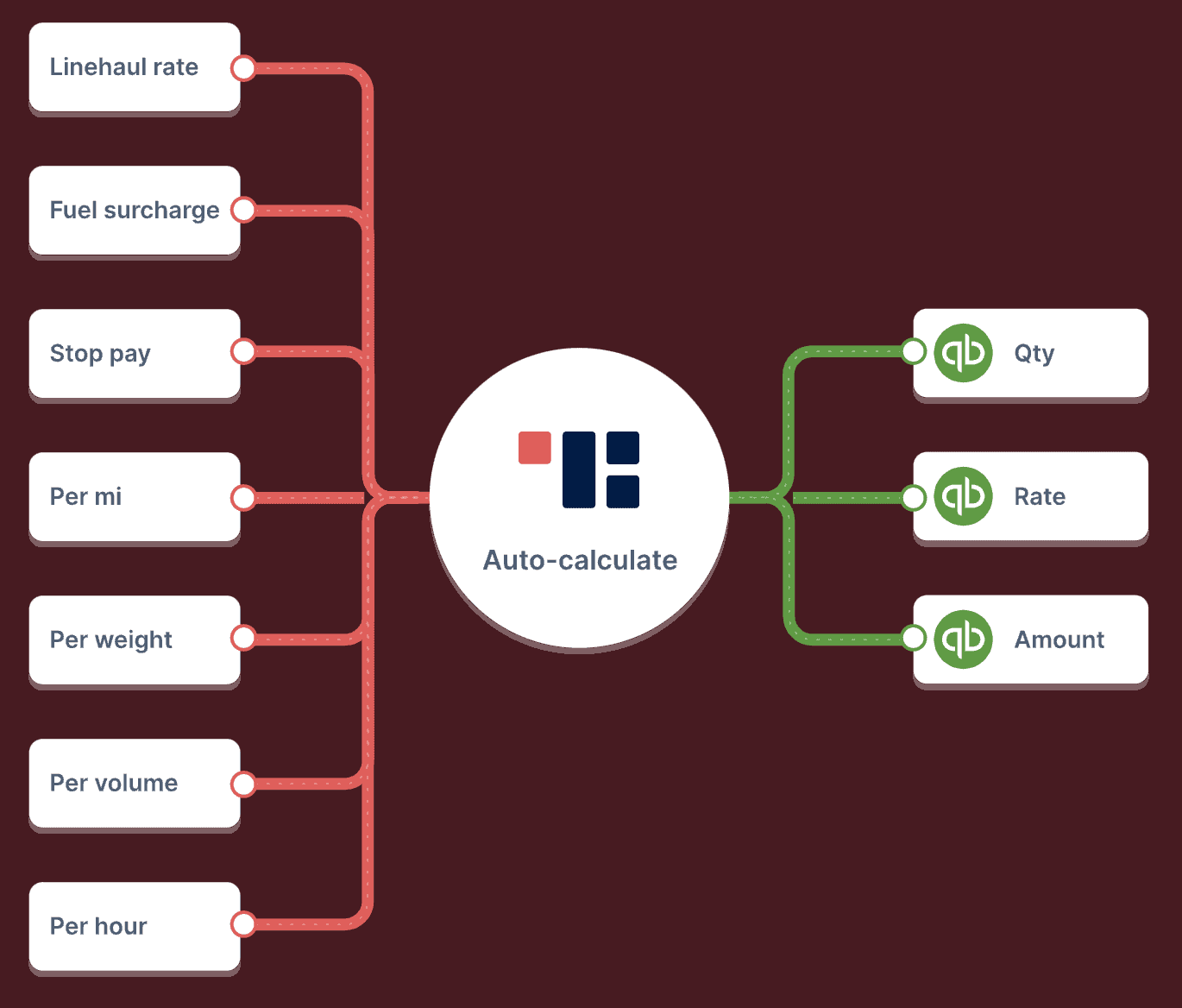

For example, as a carrier, you may support multiple rate types, such as volume, per mile, and fuel surcharges. Those need to map into QuickBooks’ available formats, which are limited to three: quantity, rate, and amount. A system like Truckbase, for example, can automatically calculate and translate those into an acceptable format that QuickBooks can process.

4. Invoicing and billing

Billing lies at the heart of any trucking operation. An integrated solution allows for automatic invoice generation based on rate cons and dispatch information. This ensures that invoices are accurate and reflect the latest data. You should be able to generate invoices either from within your TMS or QuickBooks. Additionally, you should have it sync automatically with the opposing system.

5. Document management

Attachments like PODs are crucial in the trucking industry. Integrating your TMS with QuickBooks ensures that such documents are seamlessly attached and registered in both systems.

Without such integrations, document management quickly becomes overwhelming. Saving rate confirmations and attaching the right one to the right invoice can become unwieldy. This can lead to frustrated customers, frustrated dispatchers, late payments, or erroneous payments that waste time, money, and energy to correct.

6. Product and service categories

If you’ve spent time setting up specific product or service categories in QuickBooks, you’d want a TMS that can map invoices to these categories. This ensures that accounting treatments flow through as per your QuickBooks setup.

7. Support for both QuickBooks Online and QuickBooks Desktop

While many businesses are moving to QuickBooks Online, some still prefer the Desktop version. An ideal TMS should support both, offering direct integration for QuickBooks Online and export functionalities for Desktop.

However, if you are considering one over the other, QuickBooks Online is meaningfully more flexible and integrates more seamlessly with a TMS. At Truckbase, we highly recommend you go with the Online version. Intuit (its parent company) is spending disproportionate resources to improve QuickBooks Online over QuickBooks Desktop. Moreover, you can access QuickBooks Online from anywhere, which is a major advantage in our remote and on-the-go world.

Improve your operations by seamlessly integrating QuickBooks with your trucking software

Integrating your carrier TMS with QuickBooks not only streamlines processes but also ensures that your financial data is accurate and up-to-date. With easy-to-use solutions like Truckbase, trucking businesses can truly harness the power of integration, leading to improved efficiency, profitability, and peace of mind for you and your team.

For more information on this topic, visit the Truckbase website.

FAQ

There’s no one-size-fits-all answer, as the “best” trucker software depends on your specific user needs, budget, and scale. If you have 1-5 trucks, don’t overcomplicate it; you likely can run off of Google Sheets. If you have a growing 5-50 truck asset-based fleet with multiple office employees, you’re likely best off with a modern cloud-based solution like Truckbase.

The cost of trucking industry software depends on your number of trucks and various other requirements, like ELD integrations or if certain shippers require EDI connections. After a demo, a trucking industry software company should be able to provide you with a clear quote relatively quickly.

For small trucking businesses, QuickBooks with a trucking-specific set-up tends to work best. It’s ubiquitous, relatively inexpensive, and accounting professionals all know how to use it. As mentioned in the article, we strongly recommend that you use QuickBooks Online for its flexibility and regular updates.

To keep track of your trucking business, you should implement a comprehensive transportation management system (TMS) that covers all aspects of your operations. This software can help you manage dispatching, route planning, driver schedules, vehicle maintenance, fuel costs, and financial reporting. Additionally, maintaining detailed records of your trips, IFTA calculations, expenses, and revenue, while regularly reviewing key performance indicators (KPIs) like on-time delivery rates and cost per mile, will give you a clear picture of your business’s performance.

Trucking software is commonly referred to as transportation management system (TMS) or fleet management software. These systems are designed specifically for the trucking and logistics industry, with features like dispatch management, route optimization, load planning, driver communication, compliance tracking, and automated financial reporting. Some popular TMS solutions may also include additional modules for electronic logging devices (ELDs), fuel management, or asset tracking, providing a comprehensive toolset for managing all aspects of trucking operations.